In 2024, Dubai real estate hit an all-time high, with average property prices reaching AED 1,772 per square foot—surpassing previous peaks in 2008 and 2014.

For many, this record-breaking market sparks fear, especially among local investors who vividly remember past downturns. There’s a popular story that, in 2008, people abandoned their Ferraris at the airport and left Dubai overnight.

Whether it was just a single photo or multiple deserted supercars, this tale has cemented itself in Dubai’s real estate folklore—repeated so often that many claim to have seen it firsthand. It reflects a common belief:

“Every time Dubai’s real estate reaches a new high, a crash is around the corner.”

But 2025 is different. Unlike past cycles, Dubai’s market today is built on regulations, real demand, and global investor confidence—not speculation. Expecting another crash could mean missing out on Dubai’s strongest investment cycle yet.

Let’s break down why today’s real estate market is fundamentally stronger than previous peaks—and why the biggest mistake investors can make in 2025 is waiting for a crash that may not come.

📉 2008 vs. 2014 vs. 2024: What’s Different?

Dubai’s real estate market has historically moved in boom-bust cycles, but this time, the fundamentals have changed.

📉 2008: The Global Financial Crisis (Not Just a Dubai Crisis)

Dubai’s first real estate boom was driven by:

✅ Easy credit with little regulation

✅ Rampant off-plan flipping

✅ Massive oversupply with speculative demand

At its peak, prices hit AED 1,600 per sqft. But when the global financial crisis hit, Dubai’s market collapsed—losing 60% of its value.

Many still associate this period with “Dubai’s real estate crash,” but this was a global meltdown. The U.S. housing market collapsed, European economies spiraled, and banks worldwide failed. Dubai, still a young market at the time, lacked the stability to withstand such an external shock.

📉 2014: The Expo Hype & Oversupply Crash

Dubai’s second peak in 2014 was fueled by:

✅ Expo 2020 announcement creating investment hype

✅ Foreign investors seeking quick returns

✅ Property prices reaching AED 1,500 per sqft

But just like in 2008, the market was driven by speculation, not fundamentals. Developers flooded the market with excessive supply, oil prices crashed, and the market corrected by 40% over the next six years.

🏆 2024-2025: A New Era for Dubai Real Estate

Unlike 2008 and 2014, 2024’s peak was not speculation-driven—it was built on global investor demand, regulatory reforms, and a maturing market.

1. RERA & Market Transparency Have Changed the Game

Before 2008, Dubai’s real estate market was a free-for-all, with minimal oversight and rampant speculation. But today, the Real Estate Regulatory Agency (RERA) has reshaped the landscape, enforcing transparency, accountability, and investor protection like never before.

✅ RERA regulations ensure accountability for developers and protect buyers

✅ Escrow accounts prevent off-plan fraud and ensure funds are used for construction

✅ Platforms like DXBinteract provide real-time transaction data, eliminating price manipulation

✅ Stricter mortgage & resale rules prevent over-leveraging and excessive speculation

✅ Developers enforce minimum equity requirements—often 30 to 50% must be paid before resale

Additionally, developers themselves are taking more responsibility in preventing speculation by implementing payment plans that require buyers to commit significant equity upfront. This ensures that only serious investors enter the market rather than short-term traders looking for quick flips.

The result? Very few hidden deals. Almost no blind speculation. Dubai’s real estate market now runs on data, regulations, and real investor demand, making it stronger and more resilient than ever before.

2. Global Wealth Is Flowing Into Dubai—Not Just Speculators

Unlike previous peaks, 2024-2025’s market is dominated by ultra-high-net-worth individuals (UHNWIs) looking for long-term stability.

📈 80% of luxury transactions in 2024 were in cash (Dubai Land Department)

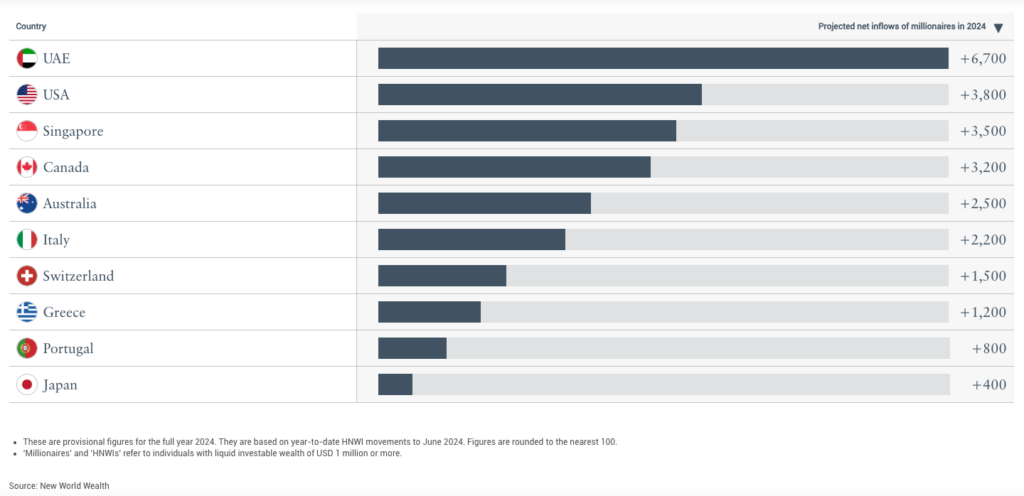

🌎 Dubai saw a 62% increase in millionaire relocations in 2023 (Henley & Partners)

🏦 New tax-free policies and investor-friendly regulations make Dubai a wealth hub

This isn’t a speculative bubble—it’s a global shift of capital.

Image credit: Henley & Partners

3. Controlled Supply = No Oversaturation

One of the biggest reasons 2014’s market collapsed was an oversupply of properties. In 2025, Dubai’s supply is carefully managed:

✅ Developers are releasing projects in phases

✅ Luxury and branded residences dominate the market

✅ Government controls prevent overbuilding

🏝 Palm Jumeirah prices rose 56% in 2023 due to limited inventory

🏙️ Downtown Dubai & Dubai Marina continue to see sustainable appreciation

Unlike 2014, developers are no longer flooding the market with excessive supply.

4. Compared to Other Global Cities, Dubai Is Still the Best Bet

For decades, investors saw London, New York, Zurich, Hong Kong, and other major cities as safe real estate havens. But today, those markets have lost their appeal due to:

❌ High taxes on property investments (15-25%)

❌ Low rental yields (2-3% vs. Dubai’s 5-8%)

❌ Saturated markets with little room for capital appreciation

❌ Rising crime & political instability driving investors away

Dubai, on the other hand, offers:

✅ Zero capital gains tax & zero property tax

✅ Some of the highest rental yields globally (5-8%)

✅ A rapidly growing economy with pro-investor policies

✅ A safe, stable environment for long-term wealth preservation

With traditional global cities losing investor confidence, Dubai has become the new real estate safe haven.

📊 Data-Driven Conclusion: Why Dubai in 2025 Is the Strongest Market Yet

| Year | Peak Price (AED/sqft) | Key Drivers | Market Outcome |

|---|---|---|---|

| 2008 | 1,600+ | Global financial crisis, speculation | Crash (-60%) |

| 2014 | 1,500 | Expo hype, oversupply | Correction (-40%) |

| 2024 | 1,772 | Economic growth, global investors, controlled supply | Sustainable expansion |

Yes, Dubai real estate reached an all-time high in 2024. But this isn’t another 2008 or 2014. Dubai’s market is now built on global demand, strict regulations, and real investor confidence.

🚀 What’s Next for Dubai Real Estate in 2025?

While no market moves in a straight line, the fundamentals suggest continued growth—though at a more sustainable pace. Unlike previous cycles, where price surges were followed by sharp crashes, the current market is backed by strong economic drivers:

✅ A growing population: Dubai is projected to reach 5.8 million residents by 2040 (Dubai 2040 Urban Master Plan). More people = more housing demand.

✅ Massive infrastructure investments: From the world’s largest airport under construction and new metro expansions to world-class developments like Dubai Creek Harbour, Palm Jebel Ali, and Dubai Islands, the city is continuously evolving.

✅ Rising global instability: More high-net-worth individuals are relocating to Dubai due to its political stability, business-friendly environment, and safety.

✅ Limited supply in prime locations: Areas like Palm Jumeirah, Downtown Dubai, and Dubai Marina are experiencing low inventory, driving further price appreciation.

📣 The Biggest Mistake Investors Can Make in 2025? Waiting for a Crash That Might Not Happen.

Over the last few years, I’ve had countless conversations with local investors. Many still say:

“Dubai will crash again, just like in 2008 or 2014. That’s when I’ll buy.”

And yet, they’ve been saying this since 2018—watching prices double while waiting for a collapse that never arrived.

Meanwhile, foreign investors have been actively buying—and profiting.

Dubai real estate today is not a bubble waiting to burst—it’s a globally recognized investment hub with real fundamentals, strict regulations, and long-term demand.

If you’re still on the sidelines waiting for another crash, you might just watch Dubai’s next boom pass you by.

Sources & References:

- Dubai Land Department (DLD): dubailand.gov.ae

- DXBinteract Real Estate Data: dxbinteract.com

- RERA (Real Estate Regulatory Agency): dubailand.gov.ae/rera

- Dubai 2040 Urban Master Plan: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/transport-and-infrastructure/dubai-2040-urban-master-plan

- Henley & Partners Wealth Report: https://www.henleyglobal.com/publications/henley-private-wealth-migration-report-2024/top-10-country-inflows

- UBS Global Real Estate Bubble Index 2024: https://www.ubs.com/global/en/media/display-page-ndp/en-20240924-gebri24.html