As the UAE real estate market concludes another record-breaking year, it’s clear why this region continues to captivate global investors. From stunning luxury properties in Dubai to emerging hotspots in Ras Al Khaimah, the UAE offers a dynamic blend of growth, opportunity, and lifestyle. Backed by insights from REIDIN Data Analytics, here’s a concise look at the latest trends and developments shaping the market.

Key Market Highlights

Rising Sales Prices

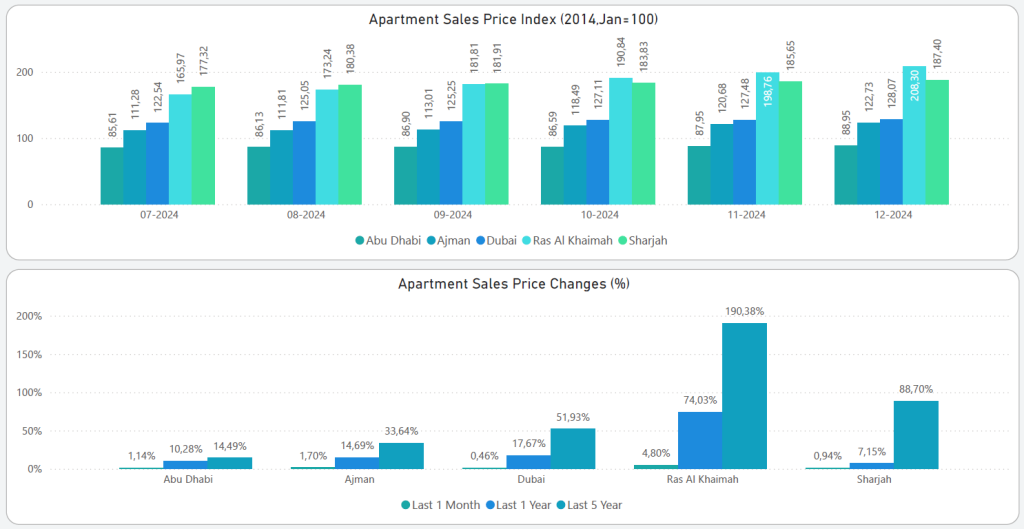

- Dubai: Residential sales prices soared by 18.03% YoY, driven by global demand for high-end homes.

- Abu Dhabi: A steady 11.12% YoY growth reflects the capital’s enduring appeal as a hub for stability and long-term investment.

For an international buyer, this growth isn’t just about numbers—it represents trust in the market’s resilience. While property prices plateaued or declined in many Western markets in 2024, the UAE has proven to be a standout performer, offering both capital growth and lifestyle benefits.

Rental Market Growth

- Abu Dhabi: Rents surged 20.19% YoY, offering landlords exceptional returns.

- Dubai: Rental prices increased by 15.67% YoY, fueled by an influx of new residents and investors.

For global investors seeking steady rental income, these figures are a testament to the UAE’s growing population and its increasing appeal as a long-term destination for expats.

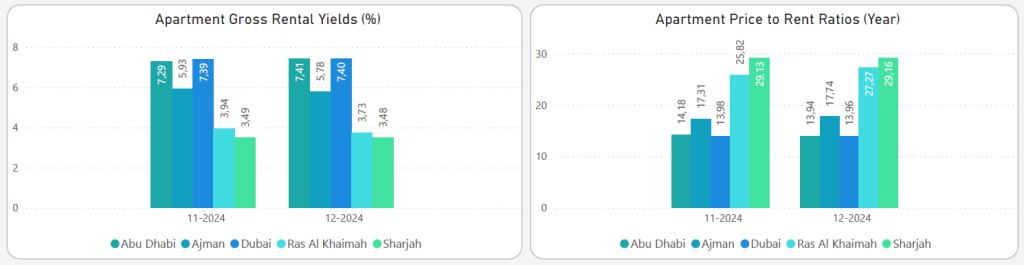

Strong Rental Yields

Gross yields in the UAE remain among the best globally, with Abu Dhabi leading at 7.4% for apartments. By comparison, cities like London and New York struggle to match these returns, especially after factoring in higher taxation and operational costs.

Emerging Opportunities Across the Emirates

The UAE isn’t just about Dubai and Abu Dhabi. In 2024, smaller emirates demonstrated exceptional growth:

- Ras Al Khaimah: Apartment sales prices skyrocketed by 74% YoY, fueled by rising demand for affordable luxury and iconic developments like Al Marjan Island.

- Ajman: With a 14.69% YoY increase in sales prices and 28.5% rental growth, this emirate is attracting budget-conscious investors seeking strong yields.

- Sharjah: Known for its cultural heritage, Sharjah experienced consistent growth with 7.15% YoY in sales prices and 27.78% rental price growth.

Spotlight on Al Marjan Island

One of the UAE’s most talked-about developments, Al Marjan Island, continues to redefine the real estate landscape. Nestled in Ras Al Khaimah, this island is home to the under-construction Wynn Casino Resort, set to be the region’s first casino.

As of December 2024, 55% of the resort’s structural concrete is complete, marking a significant milestone for this transformative project. Beyond its entertainment value, Al Marjan Island offers investors beachfront developments with high potential for capital appreciation. The synergy of luxury, exclusivity, and entertainment positions it as a standout opportunity for international buyers—imagine being part of a destination like Las Vegas or Macau in its early days.

Final Thoughts

The UAE real estate market in 2024 wasn’t just about growth—it was about transformation. From Dubai’s established luxury scene to Ras Al Khaimah’s rising prominence, the region offers opportunities for every investor profile.