Dubai’s real estate market closed 2024 with extraordinary growth, positioning itself as a global hotspot for luxury investments. But with soaring prices and an influx of international buyers, many investors are asking: Is Dubai’s real estate market in a bubble?

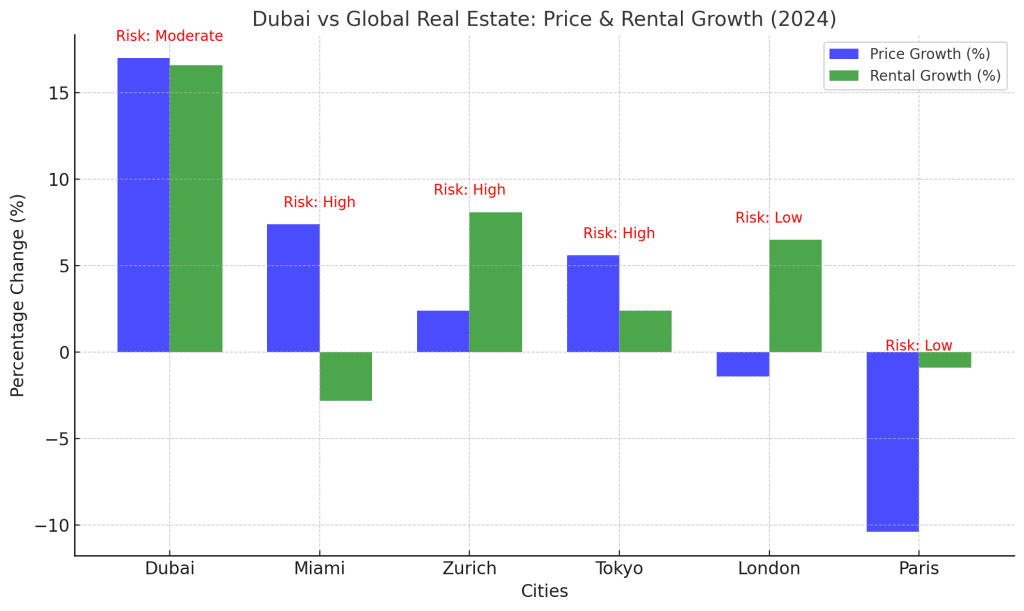

According to the UBS Global Real Estate Bubble Index 2024, Dubai’s real estate market shows a moderate bubble risk, unlike high-risk cities such as Miami and Zurich. Let’s dive into the key takeaways from 2024 and what they mean for luxury investors.

What We Learned About Dubai’s Real Estate Market in 2024

1. Record Price Growth

- Residential property prices rose by 17% in 2024, with a total increase of 40% since 2020.

- This growth was the highest among all cities analyzed in the UBS report, showcasing Dubai’s unique resilience and demand.

2. Luxury Market Performance

- The luxury segment saw robust demand, driven by ultra-high-net-worth individuals seeking trophy assets.

- Prime areas like Downtown Dubai, Palm Jumeirah, and Dubai Marina witnessed record-breaking transactions.

- Dubai’s luxury market continues to offer attractive rental yields of 6-7%, even as global markets face uncertainties.

3. Bubble Risk: Moderate, Not Alarming

- Unlike cities such as Miami (High Bubble Risk) or Zurich (High Bubble Risk), Dubai’s market remains in the moderate risk zone.

- This reflects the city’s balanced growth, supported by strong economic fundamentals and a high proportion of cash buyers.

4. Rental Growth and Affordability

- Real rents increased by 60% since 2020, keeping yields competitive for investors.

- Despite rising prices, Dubai’s price-to-income and price-to-rent ratios remain favorable compared to cities like Tokyo, Paris, or Zurich, making it a more accessible market.

How Dubai Compares Globally

| City | 2024 Price Growth | 2024 Rental Growth | Bubble Risk |

|---|---|---|---|

| Dubai | +17% | +16.6% | Moderate |

| Miami | +7.4% | -2.8% | High |

| Zurich | +2.4% | +8.1% | High |

| Tokyo | +5.6% | +2.4% | High |

| London | -1.4% | +6.5% | Low |

| Paris | -10.4% | -0.9% | Low |

Key Takeaways for Luxury Investors

1. Dubai’s Luxury Segment Remains Strong

- Luxury properties, especially in branded residences and waterfront developments, continue to drive demand.

- Dubai remains a magnet for high-net-worth individuals, offering both lifestyle benefits and solid investment returns.

2. Limited Impact of Speculation

- While speculative off-plan sales are a factor in the market, they are more prevalent in mid-range properties. The luxury market, by contrast, is anchored by end-user and investor confidence.

3. Resilient Demand in Prime Locations

- Areas like Downtown Dubai, Palm Jumeirah, and Dubai Harbour remain insulated from short-term market fluctuations due to their global appeal.

- These areas command strong rental demand and offer higher appreciation potential.

Why Dubai Stands Out in 2024

Affordability Relative to Global Cities

- Despite rising prices, Dubai’s affordability metrics for luxury buyers are more competitive than cities like Zurich, Tokyo, or Paris.

Economic Stability and Growth

- A diversified economy, strong population growth, and favorable government policies continue to underpin the market’s strength.

High Returns and Safe Investment

- Dubai offers unparalleled rental yields and a stable geopolitical environment, making it a safe haven for luxury investors.

Conclusion: No Bubble, Just Opportunity

While the UBS Global Real Estate Bubble Index highlights a moderate risk, Dubai’s luxury real estate market is far from a bubble. Strong fundamentals, robust rental yields, and sustained global demand ensure the market’s resilience.

For luxury investors, Dubai remains a premier destination offering both lifestyle appeal and long-term value.

References

UBS Global Real Estate Bubble Index 2024: https://www.ubs.com/global/en/wealthmanagement/insights/2024/global-real-estate-bubble-index.html