The Dubai residential real estate market has continued to perform exceptionally well in the third quarter of 2024, showcasing robust growth and significant interest from investors. According to the latest CBRE and REIDIN reports, the market has experienced impressive price increases, with both apartments and villas seeing notable gains compared to the previous year.

Price Surge: 20% Growth in Residential Real Estate

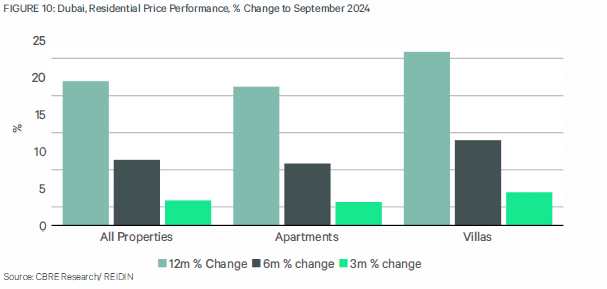

Dubai’s residential market has seen an average price increase of nearly 20% in Q3 2024, driven by substantial gains in both apartment and villa prices. Apartment prices rose by 19%, while villa prices saw an even more significant 23% increase. As a result, average apartment values reached AED 1,610 per square foot, while villas now average AED 1,980 per square foot.

Jumeirah Bay Island has emerged as a premium hotspot, registering the highest sales rates in the city. Apartments in this luxury, branded community are commanding prices of AED 11,841 per square foot, making it one of the most exclusive and expensive areas in Dubai.

Rental Growth Remains Strong

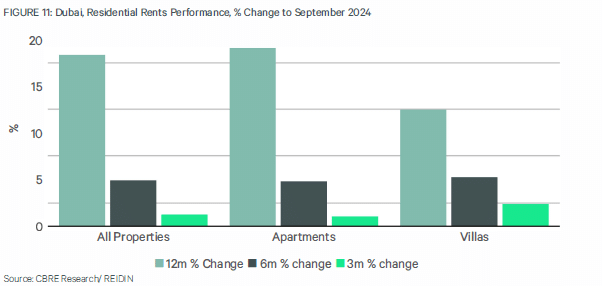

The rental market has also shown resilience, with average rental prices increasing by 18% year-on-year as of September 2024. Apartment rents have grown by 19%, while villa rents have risen by 13%. The average annual rent for an apartment in Dubai now stands at AED 72,000, while villas command an average rent of AED 215,000. Due to the ongoing shortage of available properties in prime communities, rents are expected to continue rising in the coming year.

According to the Dubai Land Department, the number of rental contract registrations has increased compared to the same period last year, driven by a 14% rise in renewal contracts. Tenants are opting to renew existing leases rather than face the prospect of significantly higher rental costs on new leases.

Off-Plan Sales Dominate the Market

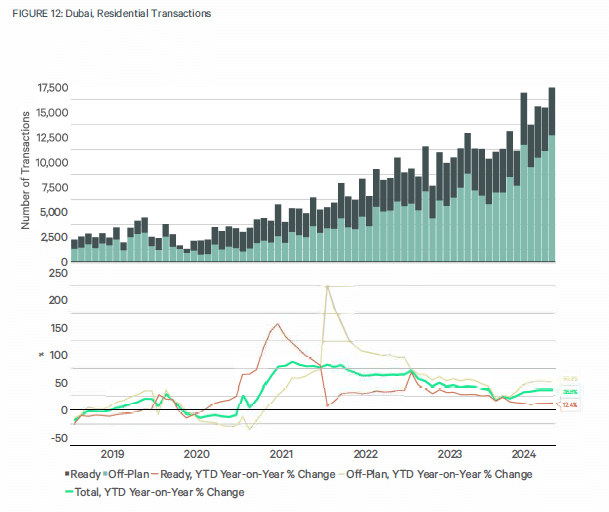

Off-plan sales have become the dominant segment of Dubai’s residential market, accounting for approximately 70% of all residential transactions. Despite this shift, the supply of new units remains relatively limited in the short term, with less than 30,000 new units expected in 2024. However, the market is anticipating a significant uptick in new deliveries in 2025, with close to 40,000 units expected to come online. The years 2026 and 2027 will likely see an even more substantial increase in supply.

Rising Transaction Volumes

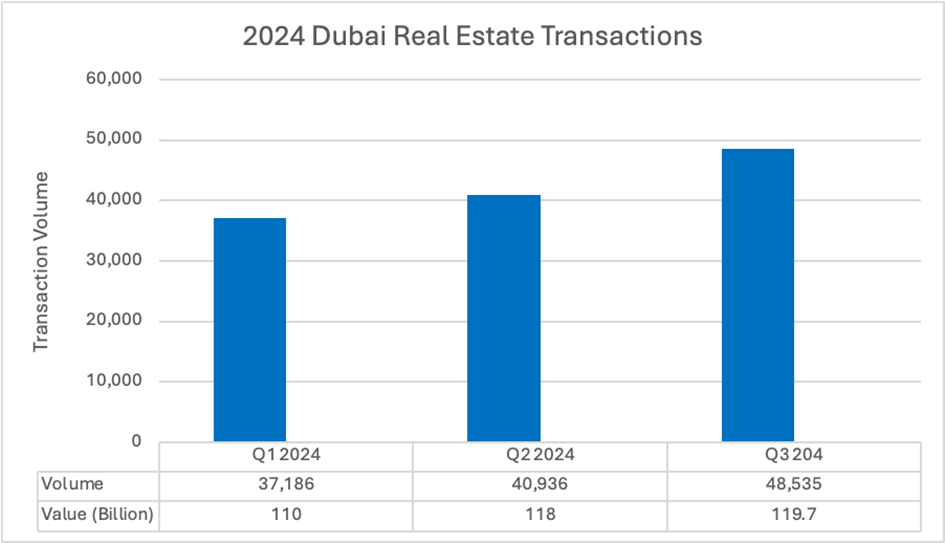

Dubai’s residential transaction volumes have surged, with over 125,000 residential transactions recorded in the first nine months of 2024, a 36% increase compared to the same period in 2023. The growth has been primarily driven by off-plan sales, which have seen a 50% year-on-year increase. Despite the rapid growth in transactions, there is a slight concern regarding the growing disparity between ready and off-plan properties. The demand for ready units has slightly declined, indicating that the market may be experiencing speculative behavior.

Market Dynamics: Investor Preferences and Speculation

During Q3 2024, Dubai’s residential market witnessed a remarkable performance, with 48,535 sales transactions totaling AED 119.7 billion. This reflects an 18% growth in transaction volume and a 1.4% increase in value compared to the previous quarter. A significant driver of this growth was the surge in off-plan sales, which can be attributed to factors such as investor preference for new projects, attractive payment plans, and a declining availability of ready properties, particularly in the luxury segment. The limited supply of ready units has led to fewer listings, further intensifying demand for off-plan properties. Sales values also demonstrated substantial growth, with off-plan transactions exceeding AED 86 billion and ready property transactions amounting to AED 33 billion. Overall, residential sales reached nearly AED 120 billion, marking a 30% increase compared to the same period in 2023.

Looking Ahead: Market Stability and Future Growth

Despite the impressive growth observed in Q3 2024, the Dubai residential market is expected to experience some normalization in the coming quarters. As new supply enters the market, we anticipate a slowdown in the rapid growth of prices and rents. However, this slowdown should be regarded as healthy for the market’s long-term sustainability, allowing for greater stability and a more balanced market.

Conclusion: A Positive Outlook for Dubai’s Residential Market

Dubai’s residential real estate market remains one of the most attractive in the region, with strong growth in prices, rents, and transaction volumes. With increasing demand and limited supply, both sales and rental markets are expected to remain positive in the near term. As new supply enters the market, we may see some stabilization, but overall, Dubai’s real estate sector is poised for continued growth in the coming years.

References

CBRE – UAE Real Estate Market Review Q3 2024: https://www.cbre.ae/insights/figures/uae-real-estate-market-review-q3-2024

REIDIN – Market Overview Q3 2024: https://reidin.com/wp-content/uploads/2024/10/Dubai-Abu-Dhabi-Real-Estate-Market-Overview-Q3-2024.pdf